WHAT TYPE OF COVERAGE DO I NEED FOR MY VEHICLE?

If you live near New Caney, Texas, and are looking for auto insurance, Armstrong Insurance is here to assist you! We can take a look at of few types of coverages to choose from for your insurance needs:

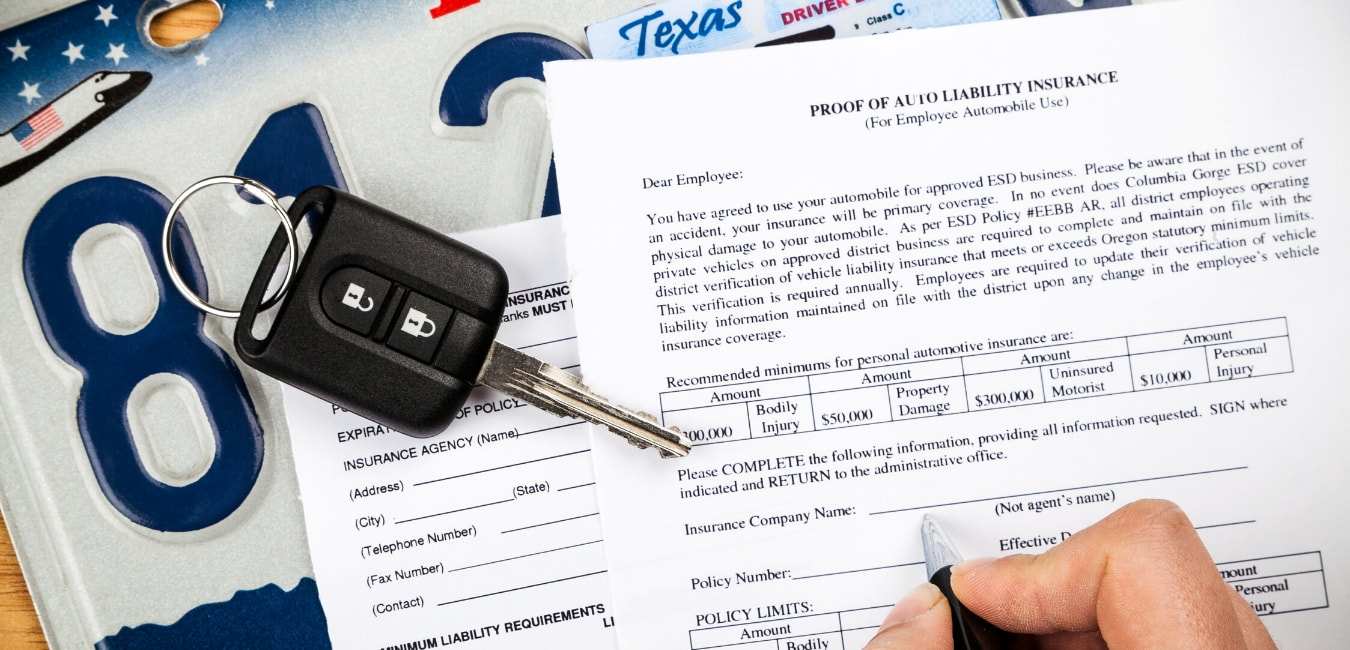

As citizens of Texas, you are required to purchase a policy for auto liability, specifically to protect other drivers who share the roads with you. With this policy, your insurance will pay for any bodily injury and/or property damage for the other guy involved in an accident in which you are at fault. This may be all that you need if you are driving a beater that won’t be affected by dents and scratches. You will have to decide if your vehicle is worth the extra cost of a better policy, or if you would rather be putting some money aside for the day your beater finally bites the dust.

Let’s take a look at Craig, who just bought a used car from his elderly neighbor. Even though it is about ten years old, the car looks brand new inside and out. It was a pretty big investment for Craig, so buying a basic auto liability policy didn’t quite seem sufficient. He decided to add collision coverage which protects him from the costs incurred should he be involved in a collision with a vehicle or other object, rollover, or damage from potholes. This way, even if he is at fault in an accident, his insurance will reimburse him for the cost of repair or replacement, minus his deductible.

In another scenario, Nell went to a local car dealership to buy her first vehicle before leaving for college. She chose a sensible sedan with good gas mileage. Nell signed up for some affordable monthly payments to get her car paid off within 3 years, but one requirement was that she purchase a full-coverage policy. A full-coverage policy consists of both collision and comprehensive coverage. Comprehensive coverage protects the policyholder from having to pay for damage caused by collisions with animals, damage from hail, fire, windstorms, fallen objects, vandalism, theft, and many more perils. By purchasing full coverage, the lender is assured that the vehicle is well protected against any possible hazards.

These are just a few of the most common auto insurance options. When you talk to an agent, you can ask about the other choices available to you. For example, if you are a business owner, you may want to consider commercial auto insurance. There is also coverage for uninsured and underinsured motorists, to protect you from having to pay when involved in an accident where the other driver does not have sufficient coverage.

At Armstrong Insurance you will find helpful agents with the knowledge to assist you in finding the right auto insurance policy. We will work with you to customize a policy resulting in a perfect fit for your specific needs. Give us a call today, and we will get you covered!